Your Business May Be Eligible for Up to $150K in Asset Write-Offs

Well, it’s that time of year again, folks. The end of the financial year is fast approaching, and that means it’s time again to trawl through your ledgers with a fine-tooth comb.

Going over the books doesn’t have to be a whole lot of fruitless drudgery, however. If you’ve recently spent on some valuable assets for your business, you may be eligible for up to $150,000 of Instant Asset Write-Offs.

Keep reading to find out if your business is eligible and how you can claim this massive tax deduction.

What is an Instant Asset Write-Off?

An Instant Asset Write-Off is a taxable income deduction that businesses with an annual turnover of less than $500 million can claim for the costs of a range of business assets. These costs include the purchase price, delivery and instalment of assets: things like production equipment, computers and tablets, office equipment, furniture and vehicles used for your business.

If the cost of these assets was under the relevant thresholds, you may be able to deduct these costs from your business’s taxable income.

This deduction applies to the purchase of new and used assets, alike. So, if your business expenses are eligible, you could be looking at some hefty savings come tax time this year!

How to Claim the Instant Asset Write-Off

You don’t need to make any special applications or claims to receive an Instant Asset Write-Off for this financial year. As long as you’ve got receipts and relevant proof of purchase for your assets, you can just include them in your annual tax return for this financial year.

The assets you’re looking to claim a deduction for must have been installed or ready for use this financial year in order to qualify for an Instant Asset Write-Off.

There’s a wide range of business assets that qualify for the deduction, but some exclusions apply. Check out this guide or speak with your business accountant to make sure of what you can deduct.

Upgrade Your Business Assets and Claim the Deduction This Financial Year

If you’re a freelancer or operating a studio in the art, design and creative spaces, now’s a great time to look into upgrading your work platforms.

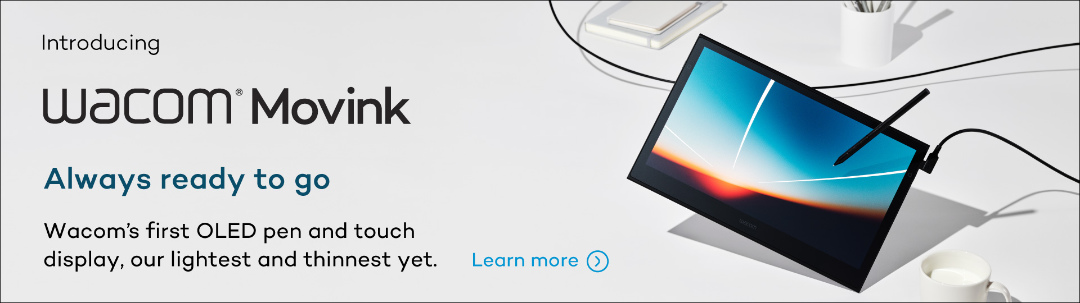

And as far as upgrades are concerned, it doesn’t get any better than the Wacom Cintiq Pro 24.

This high-definition, high-performance drawing tablet boasts a range of features that make it the perfect companion for creative professionals. With an etched glass screen, 4k display and highly responsive interface, creating on this flexible tablet feels as natural as putting pen to paper.

The Cintiq Pro 24 also comes paired with the Pro Pen 2, our state-of-the-art battery-free smart drawing tool, which features highly-accurate tilt detection, virtually undetectable lag or parallax, and unrivalled pressure sensitivity.

Best of all, purchase the Cintiq Pro 24 any time from now until the end of this financial year (June 30th) and we’ll throw in a Loupedeck CT editing console free of charge, to help you optimise your creative flow.

So, if you’re looking to elevate your creative capacity and bring value to your business, now is the perfect time for an upgrade.