Exploring the EU Digital Identity Wallet: Impacts on Business in the United States

The European Union (EU) is taking a singular approach to digital identification with the introduction of the EU Digital Identity Wallet. This initiative, part of the EU’s updated eIDAS (Electronic Identification, Authentication, and Trust Services) regulation, is designed to provide EU citizens and businesses with a secure, unified, and interoperable digital identity framework. The Wallet aims to simplify cross-border transactions, enhance security, and empower users with greater control over their personal data.

What is the EU Digital Identity Wallet?

The EU Digital Identity Wallet is a secure mobile application that allows EU citizens, residents, and businesses to store and to share verified digital credentials. These credentials may include personal identification data (e.g., name and date of birth), professional qualifications, financial account details, and even medical information.

The Wallet’s key features include:

- Interoperability: A standardized system enabling seamless cross-border transactions across all 27 EU member states.

- Privacy by Design: Users maintain full control over what data is shared, with whom, and for what purpose.

- Secure Authentication: The Wallet incorporates advanced authentication mechanisms to ensure data integrity and security.

Potential Impacts on Businesses in the United States

For businesses based in the United States, particularly in financial services and the public sector, the EU Digital Identity Wallet introduces new challenges, but also new opportunities for compliance. Below, we will discuss what this means, and how signature verification could become a pivotal aspect of leveraging this solution effectively.

1. Enhanced Transactions in Financial Services

For U.S. businesses operating in the financial services sector, the EU Digital Identity Wallet could simplify customer onboarding and compliance with anti-money laundering and “know-your-customer” (KYC) regulations. Verified digital credentials stored in the Wallet eliminate the need for cumbersome document exchanges and physical verification processes.

This creates opportunities for faster account openings, loan applications, and other financial transactions, reducing operational costs and enhancing the customer experience. For example, a U.S.-based bank offering services to EU customers could use the wallet to securely verify identities in real-time, ensuring compliance with EU regulations while streamlining the customer journey.

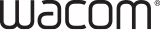

2. Opportunities for Secure Electronic Signature Verification

One of the most promising aspects of the EU Digital Identity Wallet is its potential to support secure electronic signatures. By integrating trust services like digital signatures into the wallet, businesses can verify document authenticity with unparalleled security.

For U.S. companies managing cross-border agreements, particularly in sectors like finance and legal services, this capability ensures that contracts and documents meet EU eIDAS standards, which are recognized for their robust legal framework. Incorporating electronic signature verification into workflows could reduce fraud risks and enhance trust between U.S. and EU entities.

3. Possible Implications for the Public Sector

U.S.-based public sector organizations engaging with EU citizens or entities, such as universities admitting EU students or government bodies collaborating on international projects, can also benefit. The Wallet provides a secure and standardized way to verify credentials, such as educational qualifications or professional licenses.

For example, an EU student applying for a U.S. university program could use the Wallet to share verified academic records, streamlining the admissions process. Similarly, public sector organizations involved in international procurement can validate the credentials of EU-based suppliers more efficiently.

Challenges

U.S. businesses must address several challenges to leverage the wallet effectively:

- Interoperability with U.S. Systems: Ensuring compatibility between the wallet and existing U.S. digital identity solutions is critical.

- Data Privacy Compliance: U.S. businesses must navigate strict EU General Data Protection Regulation (GDPR) requirements, particularly when handling sensitive identity data.

- Awareness and Training: Employees and stakeholders must understand how to integrate the Wallet into existing workflows securely and effectively.

Steps for U.S.-Based Businesses to Prep

1. Invest in Secure Digital Infrastructure

To utilize the EU Digital Identity Wallet, businesses should prioritize investments in secure digital systems capable of processing, verifying, and storing digital credentials. Partnering with technology providers specializing in identity verification and trust services can help bridge the interoperability gap.

2. Adopt eIDAS-Compliant Trust Services

Integrating eIDAS-compliant trust services, such as secure electronic signatures, is mission-critical. These services not only ensure compliance with EU standards but also enhance credibility and security.

3. Focus on Data Privacy and Compliance

U.S. companies must adhere to GDPR guidelines when handling data from EU citizens. Implementing robust data protection measures, such as encryption and anonymization, and it can even escalate to appointing a full-time monitor, usually called a Data Protection Officer (DPO) to foresee and dissipate compliance risks.

4. Educate Teams and Clients

Provide training to employees on how to use the wallet effectively and educate EU-based clients about the benefits of leveraging their digital credentials in cross-border transactions.

Looking Towards the Future

As the EU Digital Identity Wallet gains traction, its impact will extend far beyond European borders. For U.S.-based businesses, this is an opportunity to align with a global movement toward more secure, efficient, and user-centric identity management systems. Financial services and public sector entities that adapt quickly stand to gain a competitive edge in fostering trust and seamless collaboration with EU stakeholders.

If you’re concerned about the influence of the EU Digital Identity Wallet on your business, or you want to learn more about how verified and secure electronic signature can help you, reach out to us at [email protected].